The Hidden Power of Daily User Scenarios in Digital Services

The Hidden Power of Daily User Scenarios in Digital Services

How We Work

We examined the services from two perspectives::

- Conducted an expert analysis of interfaces with a team of two Design Leads and three UI/UX designers experienced in fintech product design.

- Organized testing with real representatives of small businesses (managers, accountants, and employees).

The result wasn't just criticism, but a useful set of solutions for daily scenarios* used by market leaders. Such information is valuable for any bank with private assessments and examples of best practices.

*Daily scenarios are everyday business tasks: checking an account, sending a payment, downloading a statement..

Our Approach and Why It Works

Over three years of diverse research, we've developed a methodology. It is a mix of rigorous analysis and live user interactions.

Expert Evaluation: We didn't just assess how modern a bank is or how beautiful its UI looks. Our designers applied Bruce Tognazzini's principles and Jakob Nielsen's heuristics to uncover non-obvious errors in logic and design. This helps identify where users might stumble.

After each task, we asked them to rate the difficulty and share their impressions. We also recorded task completion time and the number of errors. Some tests were conducted remotely with screen sharing, so we could see everything as it happens in real life, including all distractions.

Based on the data collected, we compiled a detailed report with convenient tables, lists of best solutions, and potential growth areas.

Key Insights from the Research and Their Value

Analysis of best practices revealed several clear trends:

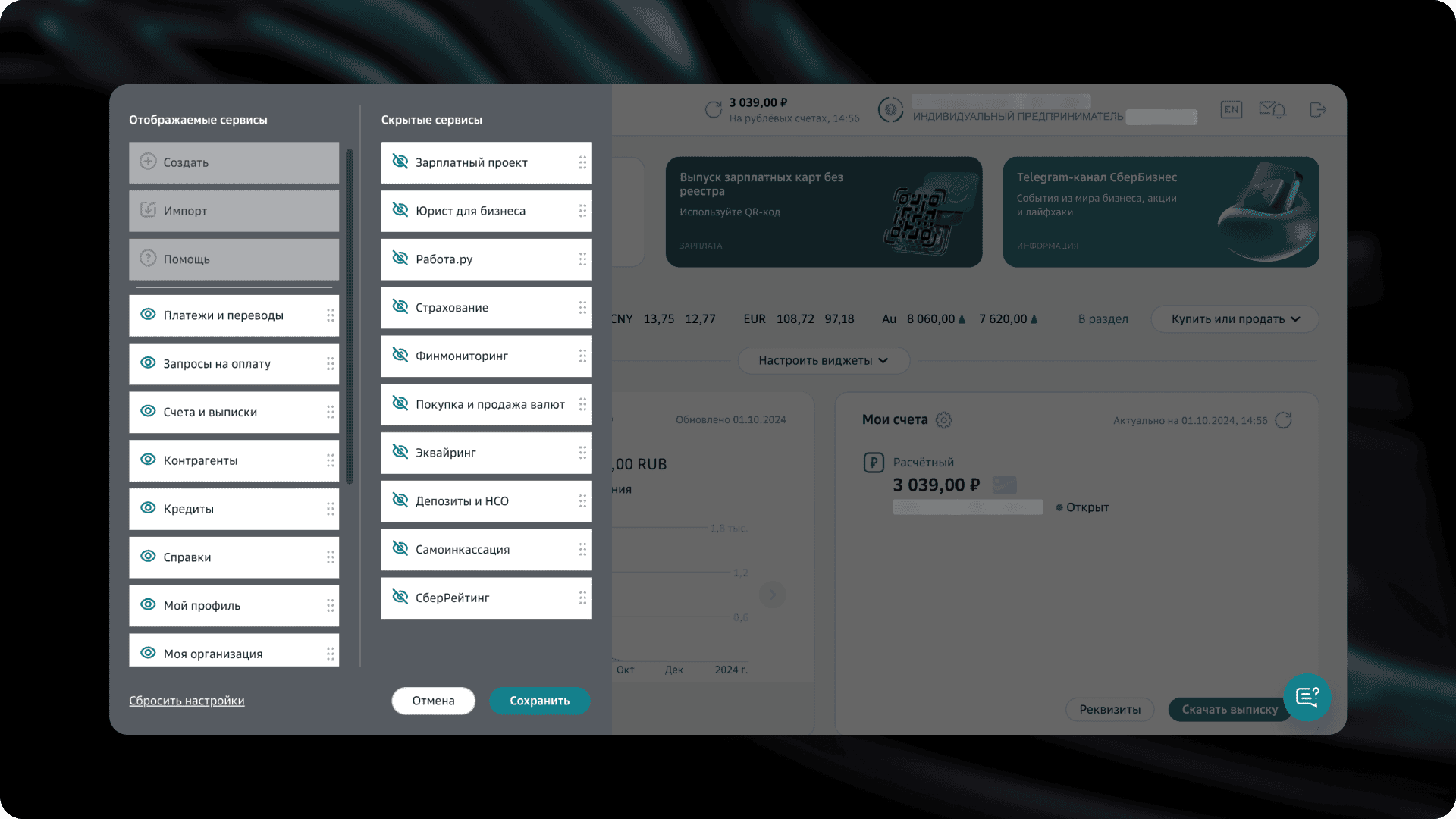

- Workspace personalization saves time. At VTB and Sber, users can customize the interface for their tasks, reducing clicks and lowering error risk.

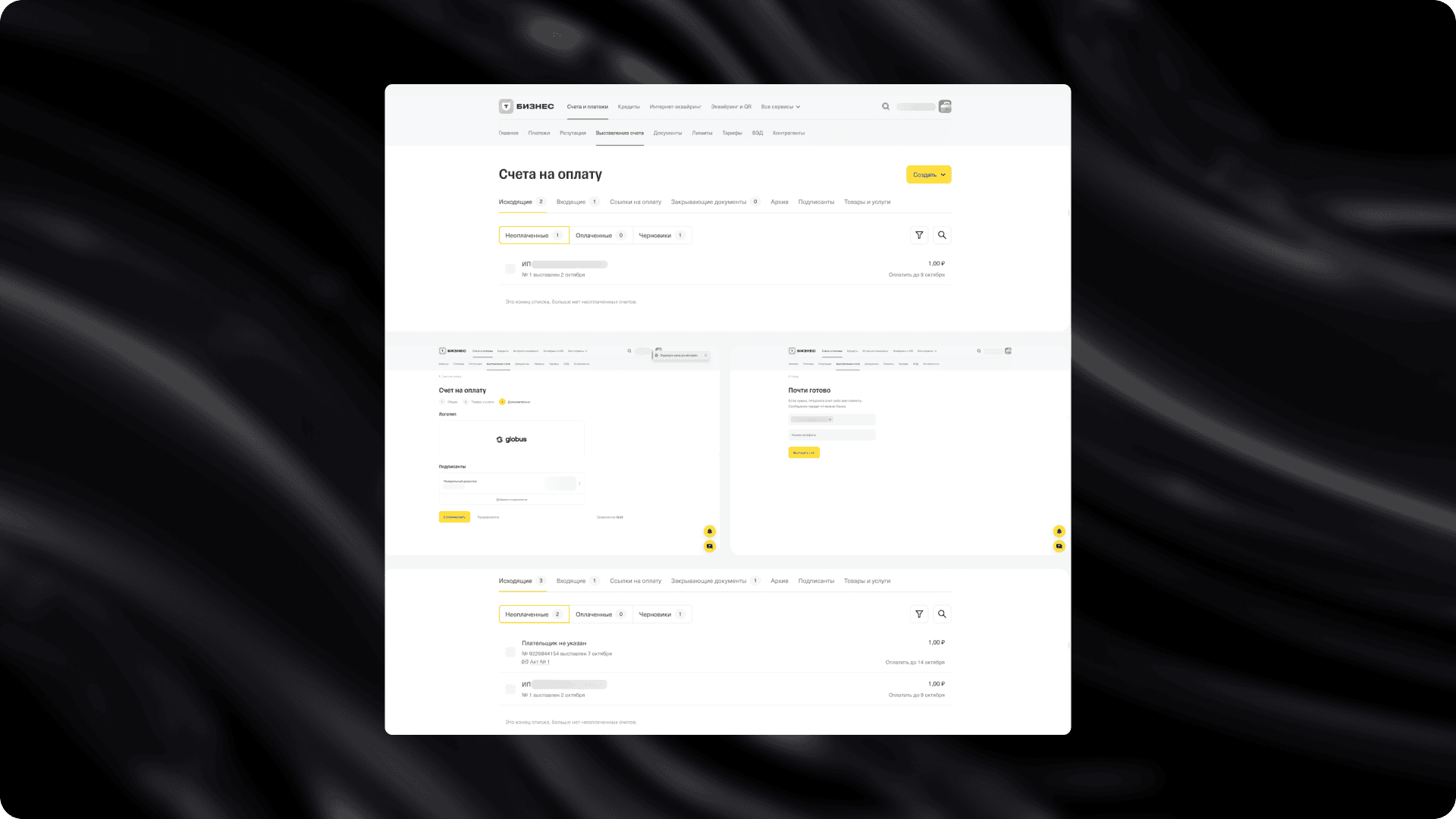

- Automation is an accountant's best friend. Document wizard and the ability to send invoices to multiple addresses (like at T-Bank) accelerate business processes.

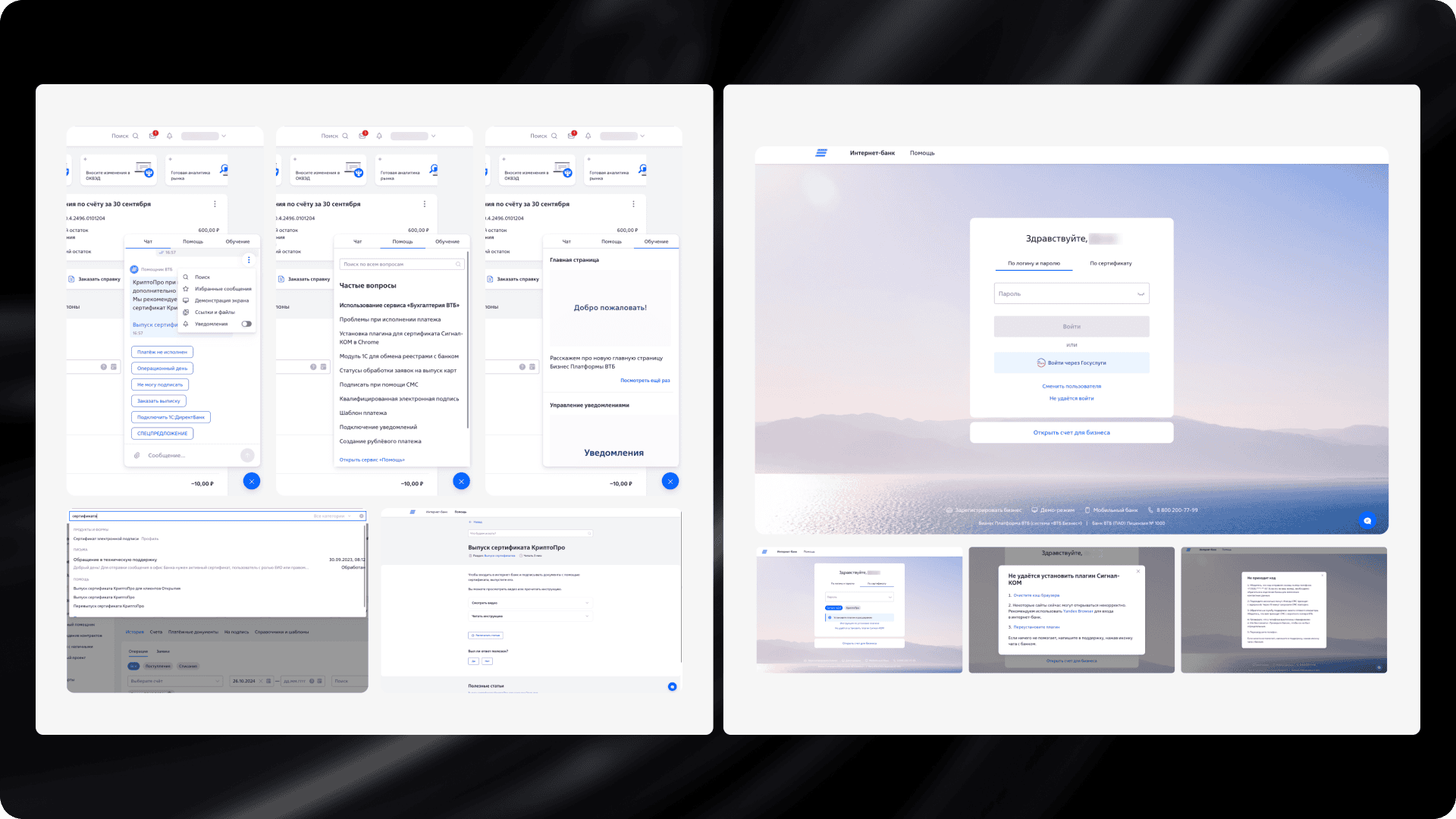

- Help should be at hand. Support communication exists everywhere, but it's important not just to implement this function, but to make it user-friendly. A pinned chat with an AI assistant and accessible knowledge base (like at VTB, Tochka, and Sber) allow users to find answers on their own. This significantly reduces the load on the bank's support service.

- Authorization should be not only secure but convenient. Multiple login options (token, biometrics, QR code) are positively received by users. Banks with only one login option raise questions about convenience and reliability.

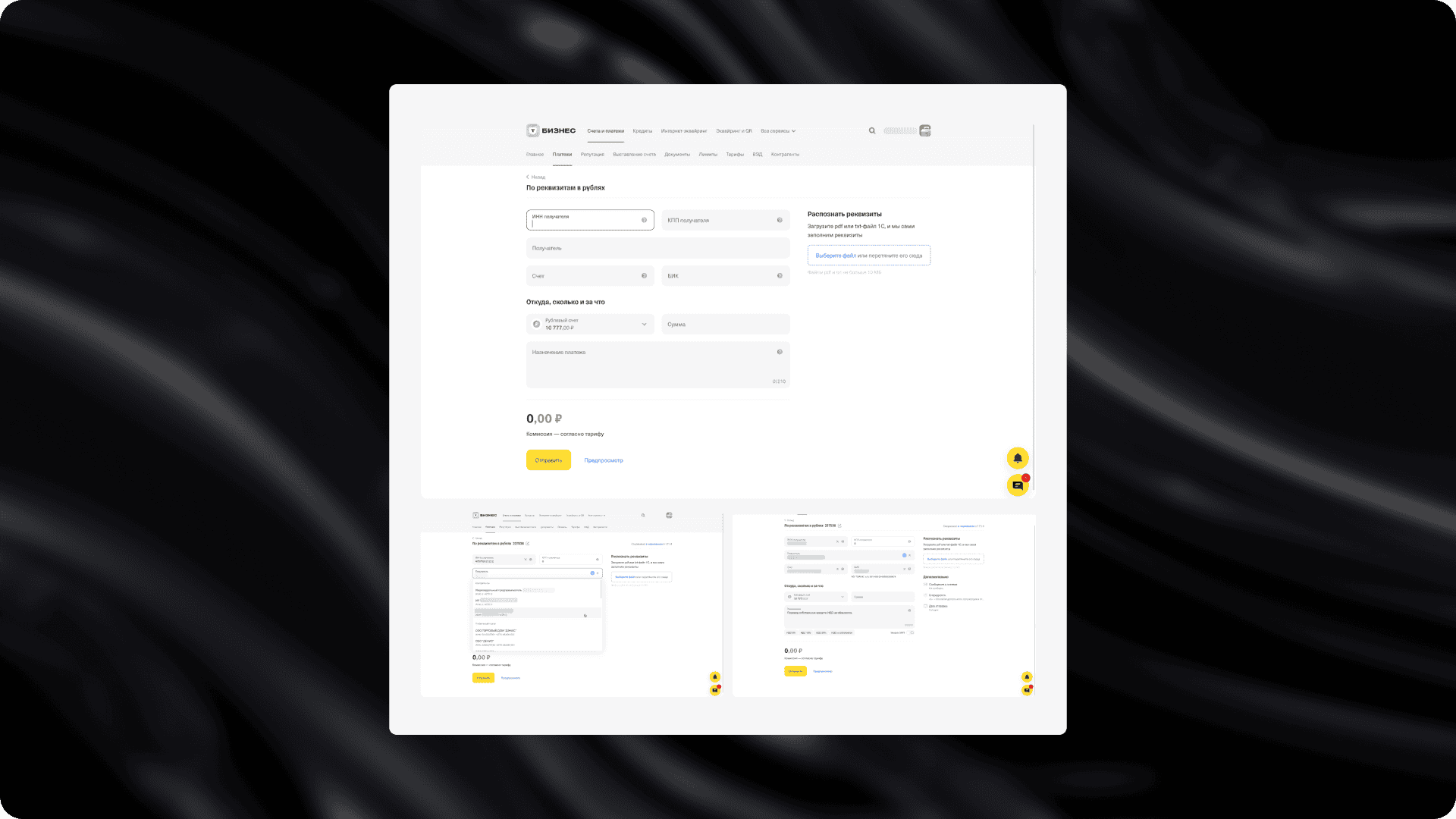

- Small changes—big effect. . Sometimes it's enough to highlight commission in payment forms, make account cards clickable, or add global search to noticeably improve user experience.

If you want to study the research results in detail, write to us at hello@mish.design.

Winners

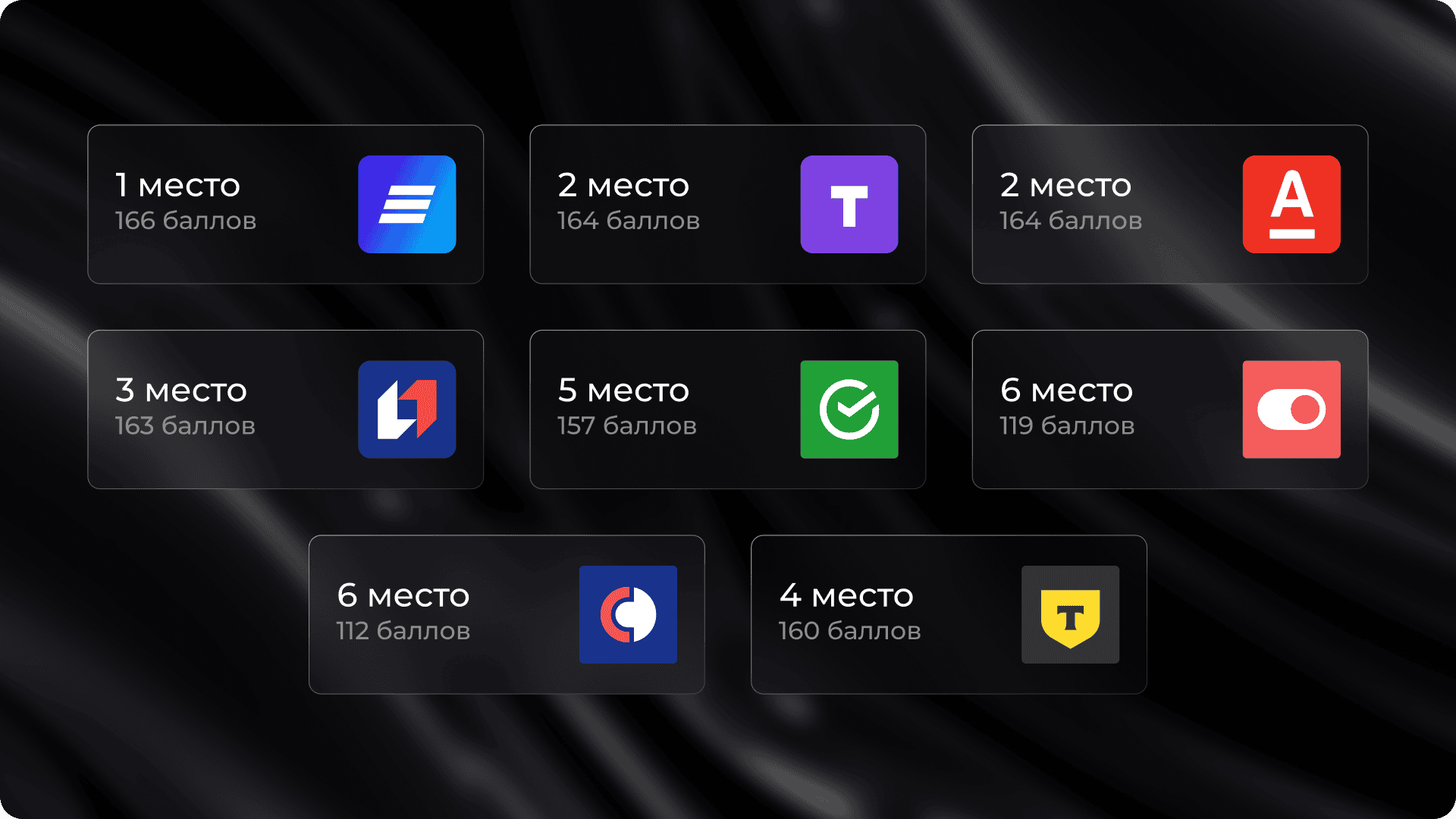

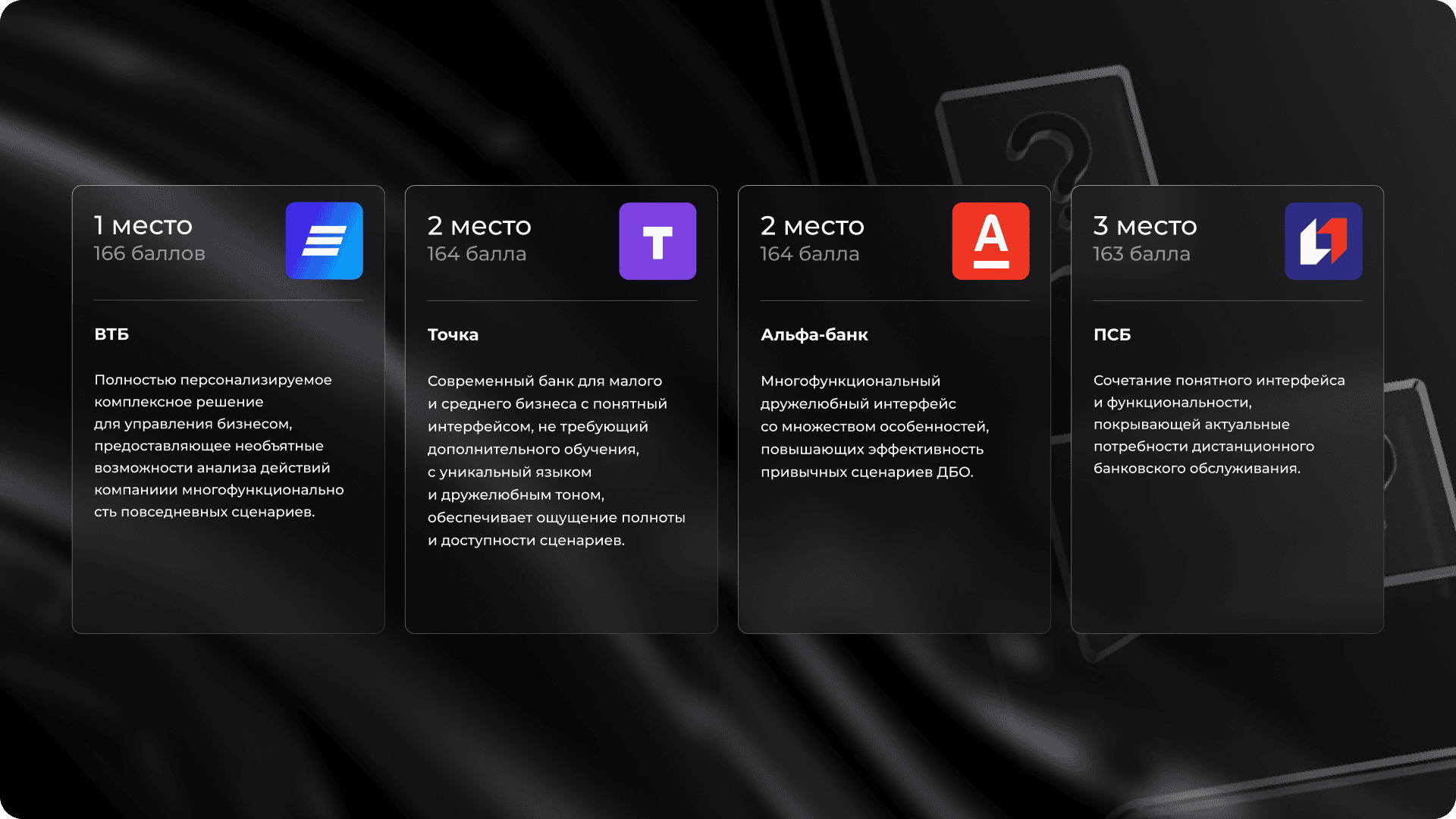

Based on the 2024 research results, four banks emerged as leaders.

VTB took first place thanks to its high level of personalization and the most functional guest zone.

Alfa-Bank and Tochka shared second place. Alfa-Bank stood out with its intuitive interface, which allows daily scenarios to be completed faster and more efficiently. Tochka confirmed its status as a modern bank with a unique, friendly communication style.

PSB rounded out the leaders' group, offering a clear interface with functionality that fully meets current business needs.

How Banks Benefit from Research Participation

Imagine: an accountant spends an extra 10 minutes every day manually entering details from a PDF invoice. Over a month, that adds up to several hours of work time! Or a manager overlooks an overdue payment on the main screen and lets down a supplier.

Our study highlights exactly these kinds of moments. We point out where the interface slows down work and suggest solutions that are already successfully implemented by others.

For a bank, this is an opportunity to gain:

- Quick wins: simple fixes that bring significant benefits (like making fees more visible or adding a search bar). Strategic vision: ideas for major

- Strategic vision: ideas for major improvements that will take the service to the next level (like document workflow automation).

Basically, the bank receives an improvement roadmap with prioritized actions and proven benefits.

Get Involved in the Research: Benefits, Impact, and How to Join

The process is simple and clear:

- We discuss with you the scenarios you want to test.

- Our team conducts user testing and expert analysis.

- You receive a detailed report with best practices, growth points, and a list of potential improvements.

Later, we can conduct a follow-up audit to measure how the changes performed. This isn't a one-time consultation, but a cycle of continuous improvements that helps make your service better for those who use it every day.

Want to make your product more user-friendly? Let's discuss.